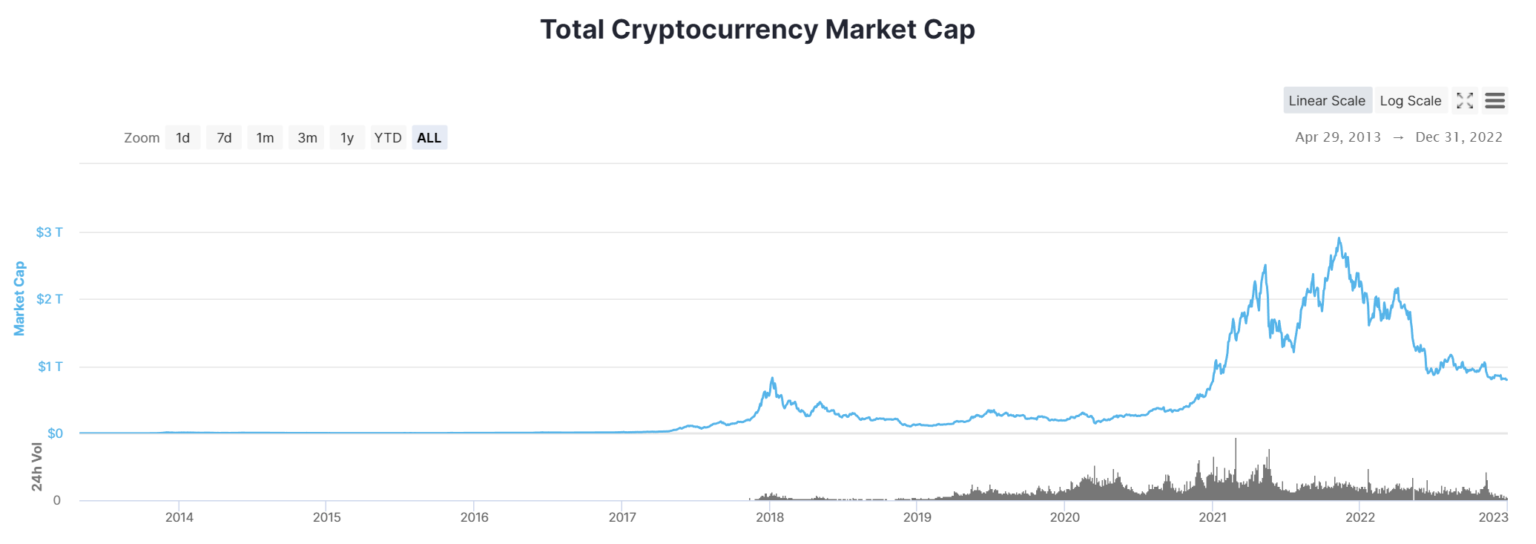

Digital assets experienced a remarkable surge to prominence in 2021. The total market capitalization of the sector reached $3 trillion in November 2021 resulting in a record-breaking performance by Bitcoin and Ethereum, propelling prices to $69,000 and $4,900 respectively. However, the “crypto winter” of 2022 marked an abrupt reversal for the sector. Major collapses such as the Terra Luna “stablecoin” and widespread insolvency of several platforms such as FTX, BlockFi, Celsius, and Voyager sent shockwaves across the industry, resulting in the overall market capitalization nearing $800 million with Bitcoin and Ethereum plunging to lows of $15,500 and $880 respectively.

Amidst industry headwinds, major players such as BlackRock, JP Morgan, and Starbucks reinforced commitment to digital assets and Web3 adoption

JP Morgan signaled the bank’s intent to transition into Web3 technology when their ‘crypto wallet’ became an officially registered trademark in the US. JPMorgan is no stranger to the technology and executed the bank’s first cross-currency Decentralized Finance [DeFi] transaction on Polygon, a public blockchain, using a modified version of the Aave protocol. The transaction involved the foreign exchange of tokenized versions of the Singapore Dollar [SGD] and Japanese Yen [JPY] as well as a simulated exercise including the buying and selling of government bonds.

Prior to this venture, JPMorgan had already explored the power of tokenization, when the bank conducted a transaction on their private blockchain involving the tokenization of BlackRock money market fund shares to use as collateral in a liquidity pool.

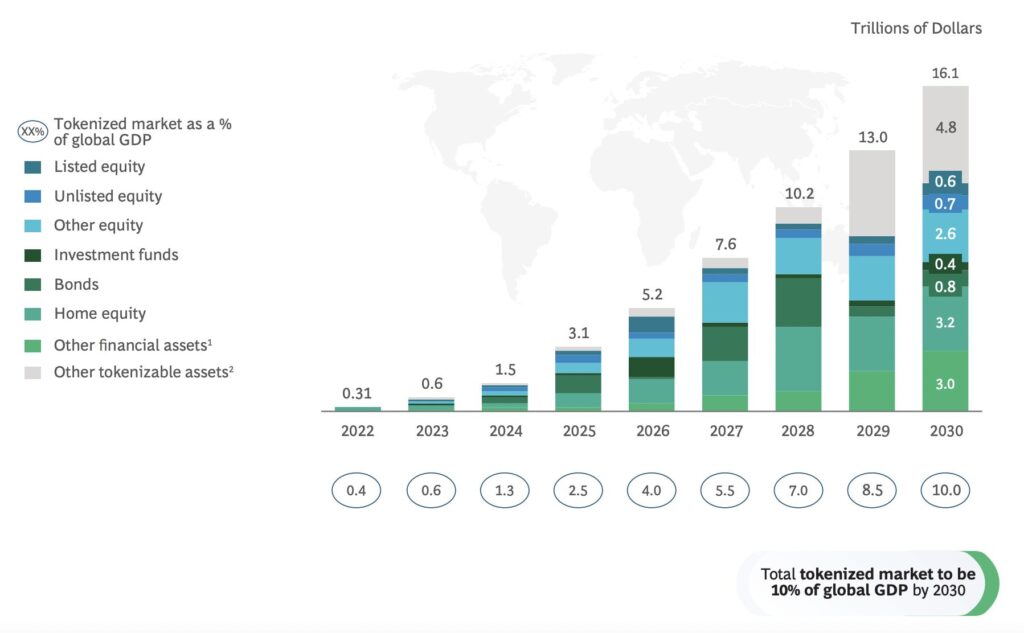

Asset tokenization could be the key to unlocking trillions of dollars in illiquid assets such as real estate, art, and insurance policies. According to a report from Boston Consulting Group (BCG) the tokenization of illiquid assets could reach $16.1 trillion by 2030 or a “best-case scenario” of $68 trillion.

Fidelity Investments is paving the way for a new era of personal finance, offering trading accounts for retail investors and allowing employers to offer bitcoin in 401(k) accounts. Fidelity Investments is preparing to become a major player in the Web3 economy, recently filing three trademark applications in the US pertaining to NFT marketplaces, virtual real estate investing, and investment services in the metaverse.

BlackRock, the world’s largest asset manager, is providing institutional clients of Aladdin the ability to custody, trade, and stake digital assets through an integration with Coinbase Prime. In addition to BlackRock, Google and Coinbase joined forces in 2022, marking a significant milestone for the Web3 space. With Coinbase Prime, Google gains access to a suite of institutional-grade services for the digital asset space – enabling secure custodianship and reporting. Through this strategic partnership Google Cloud will provide select customers the ability to pay for services using Coinbase Commerce, the same tool used by companies such as Anheuser Busch and WeWork. Developers of Web3 can leverage Google Cloud’s blockchain data through BigQuery, allowing them to quickly create web-based systems without needing complicated setup or exorbitant costs.

Central Bank Digital Currencies (CBDCs) are gaining traction worldwide. With involvement from 114 countries representing 95% of the world’s GDP, 11 nations have already rolled out their own programs – including China’s landmark pilot involving over 260 million people. CBDCs stand to revolutionize financial infrastructure in upcoming years; a monumental shift which could drastically reshape the global economy for decades to come.

Leading companies are ushering in an era of retail adoption for Web3 technology. Starbucks launched the Beta program of “Starbucks Odyssey”, an NFT loyalty rewards program featuring collectible stamps; while Reddit’s Collectible Avatars helped onboard millions of new users onto Web3. Ticketmaster is embracing the technology, partnering with Dapper Labs to give event organizers the opportunity to create special edition, event-specific NFTs associated with tickets using the Flow blockchain – best known for NBA Top Shot. As these digitalized tokens gain popularity, fans can look forward to exclusive experiences such as enhanced fan engagement programs including celebrity meetings and memorabilia.

Even fashion powerhouses such as Nike, Adidas and Prada remained on the cutting edge of consumer trends and Web3 adoption. Nike announced a Web3 platform called “.Swoosh” allowing their customers to purchase digital apparel while a collaboration with Adidas and Prada provided their communities access to creator-owned and user-generated NFTs.

The Walt Disney Company welcomed some of the biggest names in Web3 to join their Disney Accelerator program, indicating a major push for mass adoption among everyday consumers. This collaborative venture focuses on advanced applications like Augmented Reality (AR), Non-Fungible Tokens (NFTs) and Artificial Intelligence—an exciting proposition from one of the world’s most beloved entertainment companies, potentially leading to mass adoption for everyday consumers worldwide.

Despite “crypto winter” 2022 brought immense adoption of digital assets and Web3, its continued advancement reveals one essential truth: innovation takes time. Those of us old enough to remember AOL and Netscape could never imagine the world we live in today – a testament to how much can be achieved over the course of time. As Web3 continues to shape an even more connected tomorrow the measurable impact of this technology on our lives will grow increasingly apparent over the next decade.

Disclaimer: My Crypto Advisor is not a licensed financial advisor, registered investment adviser, investment adviser (as defined in the Investment Adviser Act of 1940, as amended), legal or tax advisor. This material is for informational purposes only and not intended to provide financial, investment, legal, or tax advice. Information is strictly educational and not an endorsement or solicitation to buy or sell any assets or to participate in any investment or trading strategy. No representation or warranty is made, express or implied, as to the accuracy and completeness of the information. Links to third-party websites in the material do not imply endorsement. Please consult with your own accountant, attorney, investment or other certified professional advisor in relation to any investment decision.