Tokenization is the creation of a digital token representing a real-world asset on the blockchain. Digital tokens can represent anything of value such as commodities, fine art, equities, or real estate while extending the benefits of blockchain to finance. Distributed Ledger Technologies such as blockchain enable an automated 24/7 financial system with programmable money, instantaneous settlement and transfer of value, increased liquidity, provenance, and transparency.

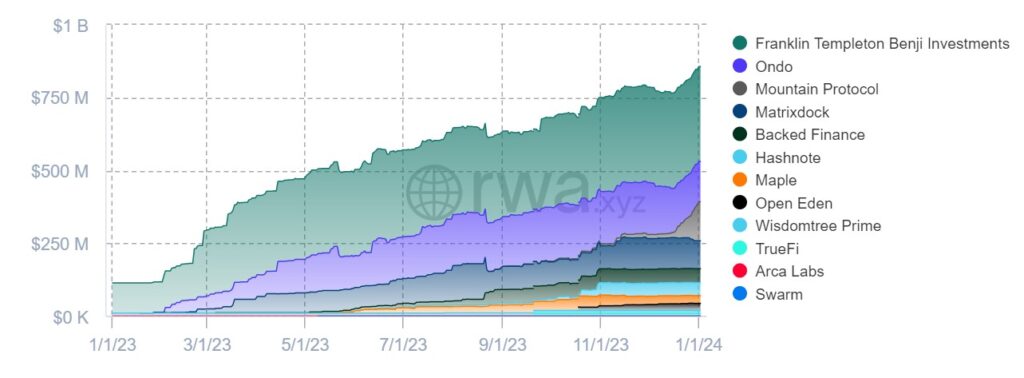

2023 witnessed the tokenization of U.S. Treasuries on public permissionless blockchains such as Ethereum, Stellar, Polygon, and Solana. The total value of tokenized U.S. Treasuries increased over 600% from $113,937,099 in January 2023 to $837,428,971 in December 2023. Some of the largest issuers of tokenized U.S. Treasuries include Franklin Templeton, Mountain Protocol, and Ondo Finance. The total market capitalization of U.S. Treasuries by blockchain is over $492m on Ethereum, $344m on Stellar, $13m on Polygon, and $11m on Solana. Coming off the near zero interest-rate environment since the 2008 financial crisis, the past two years witnessed a record acceleration of interest rate hikes in the United States, potentially incentivizing market participants to increase exposure into U.S. Treasuries on- and off-chain.

The issuance of tokenized products by Franklin Templeton and WisdomTree signify a revamping of the financial system by traditional players. PayPal, the first publicly traded U.S. company to launch a stablecoin (PYUSD), may indicate a proliferation of stablecoins from publicly traded companies in the next decade. PYUSD is designed to maintain a “stable” peg to the U.S. Dollar and reportedly backed by a reserve asset portfolio of cash deposits, U.S. Treasuries, and cash equivalents. PYUSD is the 11th largest stablecoin by market capitalization with over $268 million.

PayPal recently ventured into Decentralized Finance (DeFi) with PYUSD deployment on Curve Finance, a popular Decentralized Exchange (DEX) for swapping stablecoins. The FRAX/PYUSD liquidity pool is the fourth largest on Curve Finance by Total Value Locked (TVL) with $135 million. Additionally, the Aave DAO is taking a temperature check on a proposal which would allow PayPal to create a lending pool on their platform, giving market participants the ability to loan PYUSD to borrowers in order to earn yield. PayPal is serving as a model for established Web 2.0 companies transitioning into Web3.

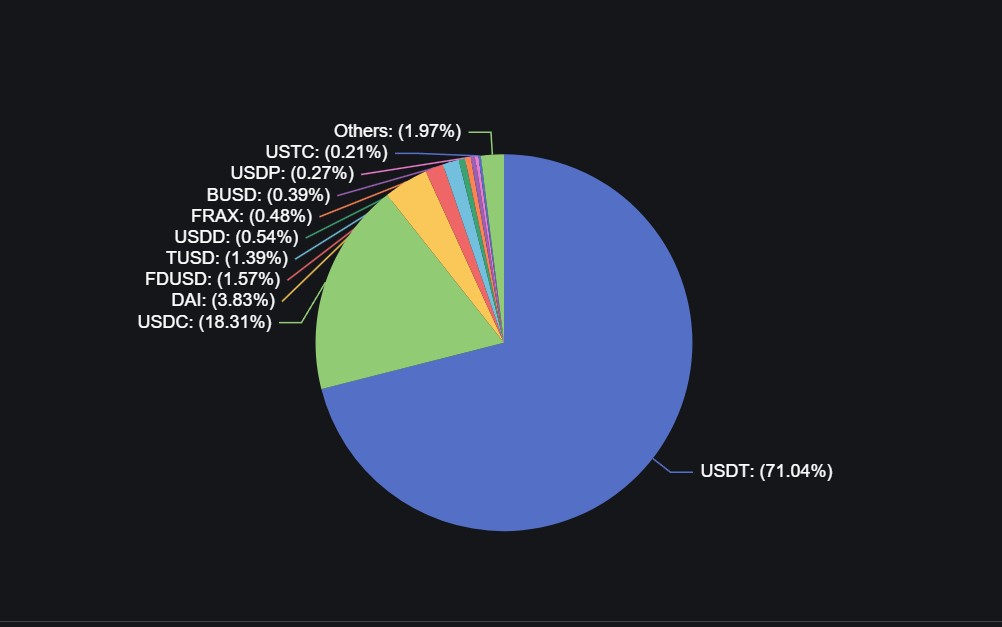

The market capitalization of the entire stablecoin sector is $134 billion with Tether (USDT) comprising 71% of the market share. The top five stablecoins by market capitalization are USDT, USDC, DAI, FDUSD, and TUSD with $95b, $24b, $5b, $2b, and $1.8b respectively. Due to the shutdown of BUSD, Binance’s stablecoin, FDUSD and TUSD witnessed an increase in market capitalization proportional to the decline of BUSD in 2023. The verdict is still out, whether PayPal or another institution, will dethrone the top stablecoins by market capitalization.

Tokenization of real-world assets such as currencies and U.S. Treasuries could democratize finance, allowing a wider audience to participate in the financial system. According to the World Bank’s Global Findex report, 1.4 billion adults were “unbanked” worldwide in 2021. The “unbanked” are categorized as individuals without an account with a regulated financial institution such as a bank or credit union. Imagine a world where anyone with a mobile phone and internet connection could access and hold a U.S. Treasury in a digital wallet. What if J.P. Morgan offered a U.S. Treasury Money Market Fund on a public permissionless network such as Ethereum? Tokenization presents an opportunity for companies ready to build and embrace a more accessible financial system.

Disclaimer: My Crypto Advisor is not a licensed financial advisor, registered investment adviser, investment adviser (as defined in the Investment Adviser Act of 1940, as amended), legal or tax advisor. This material is for informational purposes only and not intended to provide financial, investment, legal, or tax advice. Information is strictly educational and not an endorsement or solicitation to buy or sell any assets or to participate in any investment or trading strategy. No representation or warranty is made, express or implied, as to the accuracy and completeness of the information. Links to third-party websites in the material do not imply endorsement. Please consult with your own accountant, attorney, investment or other certified professional advisor in relation to any investment decision.